Accounts receivable is the amount of money that an organization is owed by its shoppers or customers for goods or companies that have been delivered but not but paid for. Nevertheless, if accounts receivable is not managed correctly, it can damage the company’s money flow and total financial well being. In conclusion, accounts receivable play an important position in a company’s stability sheet and financial operations. They represent the money owed to an organization by its customers for credit score gross sales and are thought of property. Understanding the importance of accounts receivable is crucial for effective monetary management and decision-making.

Why Cost Phrases Matter

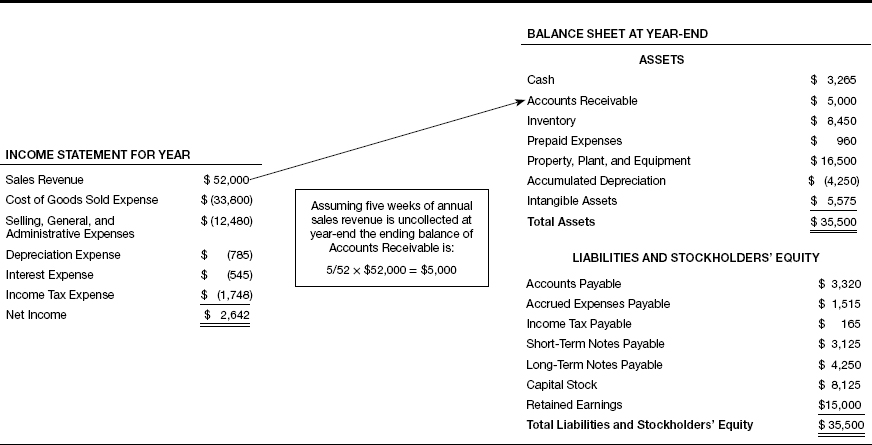

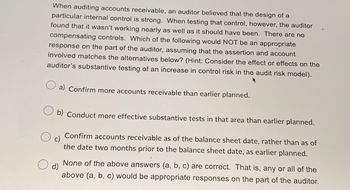

To account for receivables on the steadiness sheet correctly, companies should follow generally accepted accounting ideas (GAAP). This entails recognizing revenue when earned and recording corresponding accounts receivable at fair worth. As payments are acquired, these quantities are debited to scale back the accounts receivable steadiness whereas crediting money inflow. Understanding the role of accounts receivable on the steadiness sheet is essential for any enterprise, particularly in procurement. It is not only about monitoring cash owed; it supplies valuable insights right into a company’s monetary health and efficiency. Moreover, having a clear understanding of receivables allows companies to precisely assess their total performance and profitability.

- Examples of accounting transactions and their impact on the accounting equation can been seen in our double entry bookkeeping instance journals.

- Now that we now have a transparent understanding of what money collected on accounts receivable entails, let’s discover its impression on the balance sheet.

- In this part, we will discuss the impact of Gross Sales on Accounts Receivable from different views.

- According to one survey, 52% of finance and enterprise companies leaders agreed strongly that digitizing their accounts receivable could be important to elevating their company2.

- A cash flow statement serves as a monetary health examine, permitting businesses to gauge their liquidity and solvency.

Massive A/r Quantities Could Be Risky

Normally monetary statements check with the steadiness sheet, earnings assertion, statement of comprehensive income, assertion of cash flows, and statement of stockholders’ equity. Generally a supplier’s buyer will get into monetary issue and is compelled to liquidate its belongings. In this case the customer sometimes owes cash to lending establishments in addition to to its suppliers of goods and companies. In such circumstances, it’s the secured creditors (the banks and different lenders that have a lien on particular property similar to money, receivables, inventory, gear, etc.) who are paid first from the sale of the assets. Usually there is not sufficient cash to pay what’s owed to the secured lenders, a lot less the unsecured collectors. From a rise in gross sales volume to delayed payments, it is important to maintain observe of Accounts Receivable and be positive that funds are acquired on time to maintain a wholesome cash flow.

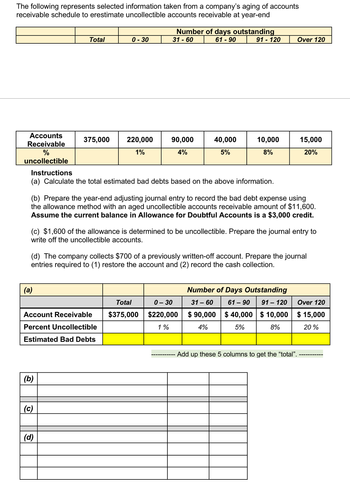

Getting Older analysis is a crucial tool for managing accounts receivable and making certain the health of an organization’s stability sheet. By breaking down receivables in accordance with the length of time they’ve been outstanding, businesses can gain useful insights into their money flow scenario and customer fee behaviors. This method not solely highlights potential risks but additionally aids in the improvement of efficient assortment strategies. To illustrate, consider a company that extends $50,000 in credit score to a new buyer. If the shopper pays inside the agreed terms, the corporate benefits from the elevated gross sales and cash move.

Enterprise Process Management

Since this web quantity https://www.simple-accounting.org/ of $98,000 is the quantity that is likely to flip to money, it’s known as the net realizable value of the accounts receivable. The Accounting Equation supplies a useful framework for understanding how a company’s financial statements are constructed. By knowing the connection between an organization’s belongings, liabilities, and equity, you’ll have the ability to higher analyze its financial health and make knowledgeable selections. Explore the impression of Accounts Receivable in Money Flow Assertion, discover methods to optimize AR processes, and improve your business’s cash move management.

If you don’t already charge a late fee for overdue payments, it may be time to consider adding one. For comparability, within the fourth quarter of 2021 Apple Inc. had a turnover ratio of 13.2. While we launched the concept of accounts receivable with a B2B instance, consumer transactions can involve accounts receivable too. It’s frequent practice for a landscaping firm to offer service to customers when they are not house. Requiring immediate payment may cause many complications — the landscaper would both have to rearrange to be paid in advance or mow the lawns solely while the shopper is residence.

Suppose XYZ Company agrees to sell $500,000 value of its product to buyer ABC on internet ninety terms—meaning the client has ninety days to pay. First, at the level of sale, XYZ Company records the $500,000 as a receivable by debiting its accounts receivable account. When the client pays, hopefully inside the 90 days allotted, XYZ Company reclassifies the $500,000 as money on its steadiness sheet. Unfavorable cash move arises when an organization’s cash outflows surpass its money inflows over a given interval.

An asset account which is predicted to have a credit score stability (which is contrary to the normal debit balance of an asset account). For example, the contra asset account Allowance for Doubtful Accounts is expounded to Accounts Receivable. The contra asset account Amassed Depreciation is said to a constructed asset(s), and the contra asset account Accrued Depletion is said to natural assets. The average time it takes for a retailer’s or manufacturer’s inventory to show to cash. If a manufacturer turns its stock six instances per yr (every two months) and allows customers to pay in 30 days, its working cycle is approximately three months. That a part of the accounting system which contains the balance sheet and earnings statement accounts used for recording transactions.

The impact of HRS receiving the $850 is to extend the present asset Money and to decrease the current asset Accounts Receivable. Observe that no revenue is reported when the $850 is obtained on January 8 and there’s no effect on HRS’s net income. RMAI Shopper ResourcesThis useful resource supplied by the Receivables Management Affiliation Worldwide (RMAI) offers data and instruments to help shoppers make informed financial selections. The calculators part includes useful tools for estimating retirement, planning debt payoff, building savings, and budgeting.

To mitigate this, the company might tighten its credit policy or provide discounts for early payment, encouraging prospects to pay sooner and thus enhancing money move. When money is collected on accounts receivable, it leads to a decrease in the accounts receivable steadiness on the stability sheet. This lower signifies that the company has efficiently converted its credit score sales into money, leading to several constructive outcomes. Companies might have the ability to use accounts receivable as collateral when making use of for enterprise loans. This is often carried out through accounts receivable financing or bill factoring, where lenders provide funds based mostly on the value of outstanding receivables. While this may improve cash flow, it often comes with interest costs or fees, and lenders may assess the creditworthiness of customers earlier than approving the loan.

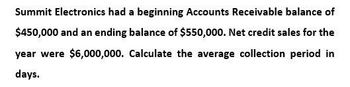

From the angle of a financial controller, the major focus is on minimizing the days sales excellent (DSO) and enhancing the turnover ratio. This often entails setting clear credit insurance policies, performing rigorous credit checks, and establishing phrases that incentivize early funds. For occasion, providing a 2% low cost for payments within 10 days can considerably speed up money inflows. If its customers start to pay on common at 45 days, the company’s cash flow might be negatively impacted.